Sommaire

- 1 Introduction of a case study, as an example 😉

- 2 In the Press: Publication on Thursday, January 20, 2022

- 3 Raw Text: Paris Court, March 2, 2020, No. RG 16/15248

- 4 Paris Court of Justice, March 2, 2020, No. RG 16/15248 –> Decision.pdf to download

- 5 URL on the Doctrine Site: 1st legal intelligence platform

Introduction of a case study, as an example 😉

A3A Association uses similar situations as an example to demonstrate that the voice of shareholders, even in the minority, is heard in legal proceedings.

Since the Court of Appeal’s announcement in favor of the Shareholders, Geci’s share price has risen again with +62%!

In its decision dated January 20, 2022, the Paris Court of Appeal ruled on the dispute between the company GECI International (“the Company”) and 13 shareholders, in connection with the disputed review of some of its press releases. related to its aviation division which was liquidated in 2013 for lack of funding for the Skylan aeronautical program

In summary below, some screenshots and the complete original texts, below.

In the Press: Publication on Thursday, January 20, 2022

Zone Bourse : GECI International : Communiqué de Presse Décision Cour d’Appel

25/01/2022 | 18:17

Bourse Direct : Geci International : la Cour d’appel de Paris confirme le jugement de première instance

25/01/2022 18:17

L’EST Républicain : Skylander : Serge Bitboul condamné à indemniser 18 actionnaires

22 janv. 2022 à 06:00

Républicain Lorain : Skylander : Geci International va devoir rembourser 11,1 M€ à la Région

03 mai 2021 à 18:44

Boursorama : GECI INTERNATIONAL : Communiqué de Presse

25/01/2022 à 18:05

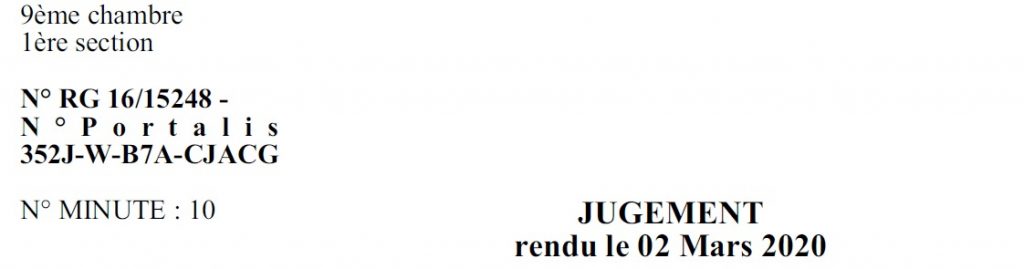

Raw Text: Paris Court, March 2, 2020, No. RG 16/15248

JUDICIAL COURT OF PARIS 1

9th room 1st section

No. RG 16/15248–No. P o r t a l i s 352J-W-B7A-CJACG No. MINUTE: 10 JUDGMENT rendered on March 02, 2020

Assignment of: October 11, 2016

APPLICANTS

Madam, volunteer speaker […]

Madam, volunteer speaker […]

Mr volunteer speaker […]

Mr. 568 Chemin du Rivier de Saint-Chef 38890 SAINT-CHEF

Mr X […]

Sir […]

Enforceable shipments issued on:

Page 1

Sir […]

Sir […]

Sir […]

Sir […]

Sir […]

Sir […]

Sir […]

represented by Maître Johann LISSOWSKI of SELEURL LISSOWSKI Lawyers, lawyers at the PARIS bar, cloakroom #C2067

DEFENDANTS

S.A. GECI INTERNATIONAL […]

Mr Z Y […]

represented by Maître Céline FREHI, lawyer at the PARIS bar, cloakroom #J100

COMPOSITION OF THE TRIBUNAL Emilie CHAMPS, Vice-President Vincent BRAUD, Vice-President Gilles REVELLES, Vice-President

assisted by Sonia BOUCETTA, Acting as Registrar during the debates and by Celia BARRIÈRE, Registrar when made available to the Registry.

DEBATES At the hearing of October 28, 2019 held in open court before Emilie CHAMPS, reporting judge, who, without opposition from the lawyers, held the hearing alone, and, after hearing the parties’ counsel,

Page 2

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

reported to the Court, in accordance with the provisions of article 805 of the Code of Civil Procedure. Notice has been given to counsel for the parties that the decision will be made available at the registry on January 13, 2020 and then extended to February 10, 2020 and March 2, 2020.

JUDGMENT Rendered publicly by making it available to the registry Contradictory In first instance

STATEMENT OF THE DISPUTE GECI INTERNATIONAL, a company listed on the Euronext New York Paris market, holding company at the head of a group bearing the same name and managed by Mr. ZY, with around 12,000 shareholders, undertook, from September 2008 , two programs involving the construction of aircraft named “Skylander” and “F-406”.

The so-called “Skylander” program was intended to raise the necessary funds for the design, development and marketing at a competitive price of a twin-turboprop short take-off and landing aircraft with a capacity of 19 passengers or approximately three tonnes of freight in extreme weather conditions. With regard to the so-called “F-406” program, it aimed to bring together the funding required for the design and assembly of a so-called “F-406” aircraft equipped with two turbines and allowing the transport of 14 passengers or freight .

The two programs were designed to be implemented mainly through three group subsidiaries: Société Reims Aviation Industries, Société Geci Aviation and Société Skylander.

Between June 2009 and February 2012, GECI INTERNATIONAL concluded several preliminary contracts with a view to ordering “Skylander” or “F-406”.

During this period, only one F-406 was delivered and funding for the Skylander program did not come through.

The listing of SOCIETE GECI INTERNATIONAL group shares was suspended, at its request, from June 7, 2012.

The two programs were abandoned in connection with the placement in compulsory liquidation pronounced for the three subsidiaries already mentioned: on April 16, 2013 for the Skyaircraft Company, and, following the sale of the activities relating to the two aeronautical programs to companies third parties, on April 17, 2014 for the Reims Aviation Industries Company and the Geci Aviation Company.

The publication on November 30, 2013 of the financial statements for the 2011/2012 financial year revealed a refusal to certify the statutory auditors.

Page 3

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

The consolidated financial statements for the 2012/2013 financial year were published following notice in the Bulletin of mandatory legal notices dated June 16, 2014.

On September 30, 2014, GECI INTERNATIONAL informed shareholders of its new strategy.

On March 11, 2016, the suspension of trading of the share ended. * By bailiff’s deed issued on October 11, 2016, ten shareholders sued SOCIETE GECI INTERNATIONAL and Mr. Z Y for compensation before this court.

These are:–who had acquired 22,860 GECI INTERNATIONAL shares, at a price of 2.41 euros per share, before the stock was suspended on June 7, 2012, for a total amount of 55,092.60 euros; –which had acquired 55,014 shares of GECI INTERNATIONAL, at a price of 2.29 euros and 1.51 euros per share, before the stock was suspended on June 7, 2012, for a total amount of 102,850 euros; –which had acquired 33,192 shares of GECI INTERNATIONAL, at a price of 3.03 euros per share, before the stock was suspended on June 7, 2012, for a total amount

al of 100,571.75 euros; -M. which had acquired 307,842 shares of GECI INTERNATIONAL, at a price of 3.01 euros per share, before the stock was suspended on June 7, 2012 for a total amount of 1,041,038.4 euros; -M. which had acquired 23,722 shares of GECI INTERNATIONAL, at a price of 2.01 euros per share, before the stock was suspended on June 7, 2012, for a total amount of 47,681.22 euros; -M. which had acquired 35,000 shares of GECI INTERNATIONAL, at a price of 2.48 euros per share, before the stock was suspended on June 7, 2012, for a total amount of 86,800 euros; -M. which had acquired 35,499 shares of GECI INTERNATIONAL, including 19,703 at a price of 3.10 euros per share, and 15,796 shares at a price of 2.82 euros per share, before the stock was suspended on June 7, 2012, for a total amount of 105,624 euros; -M. which had acquired 13,515 shares of GECI INTERNATIONAL, including 9,377 shares at an average price of 4.70 euros per share, and 4,138 shares at an average price of 4.34 euros per share, before the stock was suspended on June 7, 2012 , for a total amount of 62,029 euros; -M. which had acquired 14,793 shares of GECI INTERNATIONAL, at a price of 4.33 euros per share, before the stock was suspended on June 7, 2012, for a total amount of 64,053 euros; -M. which had acquired 36,100 shares of GECI INTERNATIONAL, at a price of 2.73 euros per share, before the share price was suspended on June 7, 2012, for a total amount of 98,553 euros.

Page 4

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

By conclusions of voluntary intervention of February 7, 2017, three shareholders constituted themselves voluntary interveners:

—Mrs. who had acquired 28,771 GECI INTERNATIONAL shares at a price of 6.51 euros per share, before the suspension of the title, for a total amount of 187,299 euros; – Mrs. who had acquired 8,943 GECI INTERNATIONAL shares at a price per share varying between 4.12 euros and 4.70 euros, before the suspension of the title, i.e. a total amount of 38,595 euros; -M. had acquired 8,934 GECI INTERNATIONAL shares at a price per share varying between 3.23 euros and 3.63 euros, before the suspension of the share, i.e. a total amount of 30,475 euros. * Having regard to the last writings notified on November 24, 2017 for the above-mentioned Plaintiffs and voluntary interveners, which conclude in the following terms: “Having regard to articles 1240 and 1241 of the Civil Code; Having regard to Articles L.225-252 and L.225-254 of the Commercial Code; Having regard to article L.465-2 of the Monetary and Financial Code then in force; Having regard to Article s 223-1 of the General Regulations of the Autorité des Marchés Financiers; Considering article 632-1 of the General Regulations of the Financial Markets Authority then in force; Having regard to Article 12 of European Regulation 596/2014 of April 16, 2014, on market abuse, which entered into force on July 3, 2016; Having regard to the case law and the exhibits adduced in the proceedings;

The Court is asked to receive the plaintiffs and voluntary interveners in their means, ends and claims, to declare them well founded and in doing so:

NOTE that between 2009 and 2012, GECI INTERNATIONAL disseminated false and misleading information concerning the SKYLANDER financing program, the SKYLANDER order book, the increase in GECI AVIATION’s production capacities, the production prospects and objectives of the SKYLANDER, the delivery date of the first SKYLANDER, the F-406 order book, and the Chinese order for the F-406; Consequently ; DETERMINE AND RULING that GECI INTERNATIONAL and Mr. Y, Chairman and Chief Executive Officer of the company, have failed to meet the requirements of accuracy and sincerity in the information transmitted; NOTE that the plaintiffs and the voluntary contributors have acquired or retained their GECI INTERNATIONAL shares, in view of this false and misleading information on the situation of the company; FIND that Applicants and Volunteer Responders suffered financial personal harm in that the false and misleading information deprived them of the opportunity to better invest their money; Consequently ; CONDEMN GECI INTERNATIONAL and Mr. Y B C to pay: -A, a sum of 51,435 euros, with interest at the legal rate on this sum from the date of issue of the summons,

page 5

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

in compensation for the financial loss he has suffered; -AT

;

Page 6

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

Having regard to the last written submissions notified on September 24, 2018 for SOCIETE GECI INTERNATIONAL and Mr. Z Y, which conclude in the following terms:

“Having regard to article L225-254 of the Commercial Code, Having regard to the case law cited, Having regard to the documents adduced in the proceedings, This Tribunal de Grande Instance is asked to:

—Finding that the plaintiffs did not establish does not feel that GECI INTERNATIONAL has disseminated false and misleading information concerning the SKYLANDER financing program, the SKYLANDER order book, the increase in GECI AVIATION’s production capacities, the SKYLANDER production prospects and objectives, the date of delivery of the first SKYLANDER, the order book for the F-406 and the Chinese orders, – To judge accordingly that the plaintiffs have not established the existence of a fault committed, damage and a causal link by the company GECI INTERNATIONAL, -Dismiss the plaintiffs of all of their claims against the company GECI INTERNATIONAL -Judge the action brought against Mr. ZY in his capacity as Chairman and Chief Executive Officer of the company GECI INTERNATIONAL, -In the alternative, Judge that Mr. ZY has not committed any fault, -Consequently dismiss the plaintiffs of all of their claims against Mr. ZY, By way of counterclaim, – Order the plaintiffs to repair the damage they have caused to GECI INTERNATIONAL and Mr. Z Y by damaging their image and consequently order them to pay the sum of 100,000 euros. In any event, – Order the plaintiffs to pay the sum of 10,000 euros to GECI INTERNATIONAL and Mr. Z Y as well as to pay all costs. -Reject the application for condemnation of the company GECI INTERNATIONAL and Mr. Z Y to pay them the sum of 52,000 euros under article 700 of the Code of Civil Procedure”;

Having regard to Article 455 of the Code of Civil Procedure, pursuant to which express reference is made to the above-mentioned writings for a fuller account of the dispute, the claims, pleas and arguments of the parties;

Having regard to the closing order of October 29, 2018;

Page 7

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

REASONS FOR THE DECISION

I- On the discussion of the legal basis of the action The COMPANY GECI INTERNATIONAL and Mr. ZY discuss in the body of their writings the legal basis of the action brought by way of summons of October 11, 2016, insofar as it refers to Article L 465-1 of the Monetary and Financial Code and Article L 632-1 of the AMF Regulation, to oppose that these provisions were no longer in force on the date of the summons.

Examination of the summons reveals that these provisions were cited in addition to article 1382, now 1240 of the Civil Code and L 225-252 of the Commercial Code and that all of the grounds referred to were followed by claims for compensation for loss of opportunity resulting from the dissemination of false and misleading information. It appears that the summons thus put the Defendants in a sufficient position to identify the nature and object of the action brought against them.

It follows that the criticism based on erroneous legal foundations is not effective.

II- On the plea based on the prescription of the action as directed against Mr. ZY According to the provisions of article L 225-254 of the Commercial Code, the action for liability against the directors or the general manager, both social and individual, is prescribed by three years from the harmful event or, if it has been concealed, from its revelation.

It follows from settled case law that in the event of successive harmful facts, disclosure occurs when the partners are aware of all the operations (Cass. com., October 21, 1974, Bull. civ. 1974, IV, n° 257 ).

In this case, the action initiated on October 11, 2016 follows the publication, following notice in the Bulletin of mandatory legal announcements of June 16, 2014, of the corporate and consolidated financial statements for the 2012/2013 financial year. The date of the notice in the Bulletin of mandatory legal announcements is relevant to establish the moment at which the shareholders had the opportunity to note the inaccuracy of several information disseminated successively between 2009 and 2012, as alleged against Mr. Y in his capacity as an issuer and at least as a corporate officer required to know the content of the information disseminated.

The argument based on prescription will therefore be rejected.

III- On the characterization of inaccurate, imprecise or misleading information In application of an established rule of case law, the prejudice of the shareholders of a company having been incited to invest in the securities issued by it and to keep them due to false information disseminated by management, withholding of information and presentation to shareholders of inaccurate accounts. Anyone who acquires or retains securities issued by

page 8

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

way of offering to the public in view of inaccurate, imprecise or misleading information on the situation of the issuing company only loses a chance to in invest its capital in another investment or to give up the one already made (Cass. com., March 9, 2010, n° 08-21.547 and 08-21.793, P+B).

It is established law that the accuracy of the information disseminated is assessed on the day of dissemination.

Moreover, from this rule of case law, it is deduced, contrary to the Defendants’ pleas, that this action: – does not suppose that the proof is provided that the information in dispute was likely to affect the price of the action , – authorizes the investor who invokes misinformation to take action against the company and its legal representatives, who cannot be unaware of the content of press releases issued by the company, regardless of the authors, – is not subject to the condition that the misconduct attributed to the manager is intentional, particularly serious and incompatible with the normal exercise of corporate functions.

In this case, the Claimants argue that the SOCIETE GECI INTERNATIONAL and its manager disseminated false and misleading information concerning the financing program for the Skylander aircraft (1), concerning the order book relating to this aircraft (2) , its production capacities (3), its production outlook and objectives (4) and the date of delivery of the first aircraft (5). Plaintiffs also allege that Defendants disseminated false and misleading information regarding the production rates and order backlog of the F-406 aircraft (6).

1- On the Skylander financing program The Claimants consider that the confident announcements made by the Defendants actually tended to underestimate the risk affecting the financing and viability of the Skylander program.

It appears from the examination of the documents produced that the SOCIETE GECI INTERNATIONAL issued the following press releases:

— the press release of April 7, 2008 indicates overall financing, as assessed by the company’s “advisory banker”, for a total amount of 115 million;

—the July 16, 2008 press release relating to the 2007/2008 annual results (p.2) puts the necessary financing at 115 million;

—the annual financial report of 31 July 2008 for the financial year 2007/2008 (p.12) puts the necessary financing at 115 million euros;

—the annual financial report of July 31, 2009 for the 2008/2009 financial year (p.13) sets out the methods of financing the program, in particular the aid to which the State and the Lorraine Region have committed, without specifying an overall figure;

page 9

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

—the annual financial report of August 6, 2010 for the 2009/2010 financial year updates the previous indications (p.13) and retains the figure of 160 million euros for the financing of the Skylander program, adding to it a “need for financing of 10 million euros for the F-406” (p . 18). On the other hand, under section “2.4 Risk factors”, this report specifies the “risks linked to the launch of the industrial phase of the Skylander program” (p.16) in these terms: “Any major industrial project, in particular in the field of aeronautics, presents, a priori, a risk of non-success, of not obtaining aeronautical certification or of exceeding costs or deadlines”. This report also provides explanations of the technical and regulatory precautions taken to limit these risks. The party related to this risk category states that the subsidiary in charge of implementing the program “cannot guarantee that the development of the Skylander SK-105 will not experience any delays or cost overruns, nor that the aeronautical certification will be obtained on schedule. If these risks materialize, this could negatively affect the financial position and future results of the Aviation division” (p.17).

—the reference document of June 7, 2011 mentions, under the heading “10.5 Expected sources of financing, necessary to honor the commitments” the same figures (p.54) and indicates that 64 million euros have been invested as of March 31 2011. The document then gives details of the planned procedures for obtaining 40 million euros in public funding and 65 million in private funding. The reference document states: “Any delay in obtaining this funding would not block the progress of the program, but would delay it, which would generate an additional cost of approximately €2 million per month of delay” (p.55);

—the press release dated February 1, 2012 puts the total financing required at 215 million euros, sets out production targets between 2014 and 2030 for 1,500 Skylanders, indicates a remaining financing of 120 million euros, and informs that a financing protocol for the same amount has been concluded with the State, the region and private investors;

—the press release of April 13, 2012 announces that the financing protocol is null and void given the estimate of experts mandated by the State quantifying the surplus to be financed at 200 million euros instead of 120 million euros, and explains the two reasons why the company considers the estimate to be excessive. The press release mentions three points of disagreement concerning the modifications made by the experts on the “business plan”, to add that private investors will therefore be privileged;

—the press release of May 4, 2012 indicates that, as long as negotiations are in progress, cash financing has been used, up to at least €2 million per month, through the use of the YA GLOBAL investment fund ;

—the press release of May 16, 2012 estimates the additional cost resulting from the delay in setting up the financing at 12 million euros and indicates that discussions are underway with the State, private investors and industrial players. The statement adds

page 10

Decision of March 2, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

that the Skylander teams are mobilized around the realization of the secondary structures, the preparation and the instrumentation of the first four test flights, for a first flight planned in September 2013, a certification in September 2014 and the first deliveries from October 2014 ;

From the overall examination of these elements of communication, it appears that, if the total financing necessary as estimated could evolve from 115 million euros in 2008, to 160 million euros in 2010, to 215 million euros as of February 1, 2012, to 295 million euros in 2012 according to the estimate made at the request of the State, compared to 222 million euros such as including the delay in financing as of May 16, 2012, there It cannot be deduced from this finding alone that the increase in the overall cost of the program was the result of an intention to dissimulate. The information given between 2008 and 2012, including two warnings issued in 2010 and 2011, on the contrary show a communication expressing the evolution of the costing and explaining it by the additional costs resulting from the delay in raising all the funds necessary for the program.

With regard, moreover, to the Claimants’ plea referring to an interview given on April 17, 2012 by Mr. ZY, who criticize the latter for having, on that occasion, affirmed that there was no problem financing, he ignores the other declarations surrounding these remarks, which, in essence, dispute the costing and the hypothesis of a production without receipt of a deposit as retained by the experts appointed by the State.

With regard, moreover, to the reproach of the Claimants who maintain that the communication of the Respondent as it appears from the aforementioned press release of May 16, 2012 created the misleading appearance of a company which would have had significant financial means whereas in reality it was about to file for bankruptcy, it does not appear justified, given the announced continuation of the search for alternative financing and the use of the YA GLOBAL investment fund. Indeed, these last elements do not appear, at the date of the press release, to be incompatible with the prospects for tests, certification and first deliveries taking place between September 2013 and October 2014. The suspension of listing as of 7 June 2012 is not sufficient either to establish that the prospects for financing and production were compromised on the date of issue of the press release.

Consequently, the examination of the information relating to the financing of the Skylander program not revealing any inaccurate, imprecise or misleading nature, the ground of this head will be rejected.

2- On the Skylander order book The Claimants consider that the announcements made on June 15, 2009, November 19, 2009, August 13, 2010, June 21, 2011, December 1, 2011, February 2, 2012, February 22, 2012 , dealing with memorandums of understanding, “Memorandums of understanding”, letters of intent and firm orders concluded with third parties for the delivery of Skylanders were misleading because they relate to insufficiently reliable orders.

page 11

Decision of March 2, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

The June 21, 2011 press release relied on by the Claimants cannot be usefully relied upon in these proceedings insofar as its examination reveals that it was issued by GECI Aviation only, and not by GECI INTERNATIONAL.

It is settled case law that press releases relating to the order book must indicate the method of determination followed and that, failing this, it is considered that the public has not been able to assess their meaning (AMF CDS, March 31, 2011, SAN- 2011-07; Cass. Com., October 7, 2014, No. 13-19538; AMF CDS, 5 June 2015, SAN-2015-12).

Examination of the press releases reveals that reference is made only to preliminary contracts and more particularly:

—the June 15, 2009 press release relates to “two memorandums of understanding” and announces “10 aircraft orders for an amount of 60 million dollars”, including 6 F-406s and 4 Skylanders and refers in addition to “ ongoing negotiations (180 aircraft including 70 for the F-406 and 110 for the Skylander)”. This press release mentions the number of orders and an overall amount without additional indication relating to the notions of pre-contract and methods of establishing the figures announced;

—the November 19, 2009 press release relates to a memorandum of understanding “for the firm order” of 10 Skylanders and also mentions a “Skylander SK-105 commercial portfolio which today amounts to more than 600 aircraft, including more of 300 under negotiation”. This press release refers to an order for 10 aircraft and an unspecified commercial portfolio relating to pre-contract concepts and methods of establishing the figures announced;

—the press release of August 13, 2010 indicates that “the group today has protocol agreements for a total of 29 aircraft, 15 F-406 and 14 Skylander SK 105, and which represent a portfolio of nearly 150 million euros “, and adds, with regard more particularly to the Skylander program, that “Sky aircraft (…) has a commercial portfolio which today covers more than 550 aircraft. In this portfolio, fourteen aircraft are subject to formal agreements with customers in the form of a Memorandum of Understanding or a Letter of Intent. These fourteen aircraft represent a turnover of 75 million euros”. This press release announces 14 Skylanders being the subject of protocol agreements without specifying the concept of preliminary contract, and refers to their weight in the turnover without specifying whether it is a figure of business realized or estimated for the future, and advances a commercial portfolio quantified according to an unspecified method;

—the press release of December 1, 2011 mentions the signing on November 30, 2011 of a Memorandum of understanding relating to 40 Skylanders and defines this agreement as “a formal agreement of wills, prior to a sales contract. Preparatory preliminary contract signed between two parties, intended to express the main elements of the will of the parties and to lay down the principles of the negotiation of the future contract”. The press release adds that “This announcement brings the total number of aircraft under protocol agreements to 151 Skylanders (including 10

page 12

Decision of March 2, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

orders), which would represent a potential turnover of 700 million euros”. This press release, although it recalls the meaning of the legal act it announces, refers to “aircraft under protocol agreements”, to orders and to a potential turnover quantified according to an unspecified method;

—the press release of February 2, 2012 refers to the same act dated November 30, 2011, adds that the 40 aircraft “would represent a potential turnover of 260 million dollars” and announces the signing of the sales contract expected in the first quarter of 2012. This press release does not contain any details relating to the notion of preliminary contract or to the method of establishing the potential revenue indicated;

—the press release of February 22, 2012 announces a Memorandum of understanding relating to 2 Skylanders, expresses “a confirmed commercial success” and states: “Since the Paris Air Show 2011, the rhythm of signatures with air transport operators has intensified: they bring, to date, the total number of commercial agreements to 413 aircraft, including 10 orders”. This press release does not contain any details as to the notions of preliminary contract and commercial agreement or as to the method of establishing the figures announced.

It appears that the press releases examined above were imprecise, inaccurate or misleading on the day they were issued, which is likely to engage the liability of the Defendants.

3-On the production capacities of the Skylander The Claimants claim that the information concerning the production capacities of the Skylander was false and misleading.

It is common ground and it appears from the examination of the documents produced that the Respondents issued the following press releases:

—the press release of August 10, 2009 announces a mobilization for the finalization of the plans of the plant and in order to have all the authorizations to be able to start the construction of the assembly plant before the end of the year;

—the press release of July 28, 2010 informs that the industrialization phase is launched with the cutting of the first chips at Baccarat Précision in Lorraine at the end of April 2010;

—the August 13, 2010 press release refers to an acceleration phase, with the increase from 60 to 150 employees;

—the press release of November 30, 2010 indicates that the tender procedure for the construction of the assembly plant has been launched, with a view to production, between 2012 and 2018, of 9 aircraft per month at a steady rate cruising;

—the press release of June 10, 2011 announces that the production of parts has started at the suppliers, for a final assembly scheduled to begin in the fourth quarter of 2011 and for a first flight

page 13

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

expected in the second quarter of 2012;

—the press release of February 1, 2012, corroborated by local press articles and an AFP dispatch (Exhibit No. 67 Defendants), mentions the inauguration, on December 13, 2011, of the assembly hall, the installation of the first buildings and the presentation of the future series aircraft production plant by SEBL, responsible for the call for tenders, and the company Perthuy Constructions, selected as prime contractor for the industrial complex dedicated to assembly production aircraft;

—the press release of May 16, 2012 announces a decline in revenue for the aviation division and delays in financing.

From an overall examination of the information contained in the press releases above, it appears that only indications are given concerning the stages, between August 2009 and February 2012, of the design, the call for tenders, and the construction of the first elements of the factory intended for the production of the Skylander, the workforce employed in this context, and the state of the production of parts at the suppliers, before the communication of information on financial difficulties in May 2012. It cannot be deduced from this that this information was imprecise, inaccurate or misleading on the date of its distribution.

4-On the Skylander’s production prospects and objectives The Claimants argue that the press releases of February 1, 2012, April 13, 2012, and May 16, 2012, already mentioned in 1- above, were misleading in that they relate to production objectives that have been maintained although they have become unachievable given the estimate made of the financing needs according to the Experts mandated by the State.

The same reasons as those developed in 1- above will lead to the rejection of this ground, insofar as neither the disagreement between the Defendants and the State on the estimate of the overall financing necessary, nor the continuation of negotiations with the State and the search for alternative financing, had the effect of rendering unrealistic, at the date of these press releases, the outlook and production objectives formulated for the next two years.

5-On the scheduled date for the delivery of the Skylander The Claimants claim that the forecasts for the first deliveries of the Skylander, indicated without taking into account an average certification period of around 5 years, were based on false data and were therefore misleading.

It appears from the contradictorily debated documents that the press releases of June 15, 2009, August 10, 2009, November 19, 2009, July 28, 2010, August 13, 2010, November 30, 2010, March 15, 2011, June 21, 2011 and the reference document of June 7, 2011, provide for delivery in 2012. In a singular way, the press release of June 10, 2011 provides for a first delivery in 2013. This same year is retained by the press release of December 1, 2011. Three press releases, dated February 1, 2012, February 22, 2012 and May 16

Page 14

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

2012, indicate a date of first delivery postponed to 2014.

It is common ground that the certification of the Skylander began on June 8, 2010 and that the regulations then in force provided for a period of 3 years from the initial request for obtaining certification.

The Claimants, who maintain that the Skylander could not be delivered before obtaining their approval in June 2015, concede that the application for certification can take between three and five years, but emphasize that this certification is preceded by a another approval, the DOA (Design Organization Approval), which according to them requires between six months and two years of investigation.

The Claimants do not establish that these deadlines are incompressible.

Moreover, the press releases of June 15, 2009, August 10, 2009, and November 19, 2009, announcing a forecast delivery date even before any filing of a certification request, which only took place on June 8, 2010, can only be qualified as imprecise, inaccurate or misleading, insofar as they lack a factual basis at the date of their issue.

This failure constitutes a fault of such a nature as to engage the responsibility of the Defendants, without the excess of the means of the Plaintiffs relating to the subsequent announcements of first deliveries being able to be welcomed.

6-On the F-406 order book The Claimants consider that the announcements made on June 15, 2009, August 10, 2009, July 7, 2010, July 28, 2010, August 13, 2010, December 9, 2010 and December 12, 2010 August 2011 concerning orders were misleading because they led to believe in an increase in production and related to orders that were not sufficiently reliable.

The means formulated under the press releases issued by the COMPANY GECI AVIATION, not sued in this case, can only be rejected.

Consequently, only press releases dated June 15, 2009, August 10, 2009, August 13, 2010 and August 12, 2011, issued by GECI INTERNATIONAL and its Manager, will be examined:

—the June 15, 2009 press release relates to “two memorandums of understanding” and announces “10 aircraft orders for an amount of 60 million dollars”, including 6 F-406s and 4 Skylanders and refers in addition to “ ongoing negotiations (180 aircraft including 70 for the F-406 and 110 for the Skylander)”. This press release mentions the number of orders and an overall amount without additional indication relating to the notions of pre-contract and the methods of establishing the figures announced;

—the press release of August 10, 2009 announces “8 firm orders and options for its F-406 aircraft”. This press release does not specify either the contractual framework of the orders or the method of establishing the figures.

page 15

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

advertisement ;

—the press release of August 13, 2010 mentions that “the group today has protocol agreements for a total of 29 aircraft, 15 F-406 and 14 Skylander SK 105, and which represent a portfolio of nearly 150 million euros “. This press release adds, with regard more particularly to the F-406 program “the results of the reinforcement of the company are reflected today by a number of aircraft in protocol of 15 aircraft including the memorandum of understanding relating to 10 aircraft for a Chinese customer signed last July, which has been added to the commercial portfolio which today includes 217 aircraft”. This press release mentions 15 F-406s subject to protocol agreements without defining the notion of pre-contract and advances a commercial portfolio quantified according to an unspecified method;

—the press release of August 12, 2011, which refers to an “exceptional Paris Air Show, which made it possible to total 68 aircraft in protocols or orders, including 51 Skylander (…) and 17 F-406”, does not provide any details on the concepts of preliminary contract and orders nor on the method followed for the establishment of the announced figures.

It appears that the aforementioned press releases were, on the day of their issuance, imprecise, inaccurate or misleading, which is likely to engage the liability of the Defendants.

IV-On the argument based on external circumstances The Defendants argue that the mere failure to occur subsequently of an event announced in a press release is not sufficient to establish the erroneous nature of the latter.

The imprecise, inaccurate or misleading nature of the information disseminated, when it has been accepted, having been so only after an examination of its content on the day of dissemination, the plea can only be rejected.

V-On the damage The Claimants, following the faults found, may claim, not the difference between the sale price and the price they would have obtained in the absence of erroneous information, but compensation for the damage resulting from the loss of a chance to make an accurate decision. Thus, the damage suffered by the shareholders consists in the retention of the action with overvalued promising prospects.

From a rule of constant case law, it follows that the compensation for a loss of chance must be measured by the chance lost and cannot be equal to the advantage that this chance would have provided if it had been realized (Cass. 2nd civ ., April 9, 2009). In terms of the dissemination of inaccurate, imprecise or misleading information, lump sum compensation is the rule (CA Paris, 9th ch. sect. B, October 31, 2008.).

In this case, it appears that, when the Plaintiffs acquired their shares, they had an acquisition value ranging from 2.02 euros to 6.51 euros per share. The contradictorily debated documents indicate that when trading resumed on March 11

page 16

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

2016, the share was worth 0.42 euros, and at the beginning of 2018, it was worth 0.25 euros.

These elements and the nature of the shortcomings retained will lead to the fixing of a value of 0.85 euros per share. It follows, for each of the Claimants, the following indemnities:

—For the holder of 22,860 shares: the sum of 19,431 euros;

—For the holder of 55,014 shares: the sum of 46,761.90 euros;

—For holder of 33,192 shares: the sum of 28,213.20 euros;

—For , holder of 307,842 shares: the sum of 261,665.70 euros;

—For the holder of 23,722 shares: the sum of 20,163.70 euros;

—For Mr. holder of 35,000 shares: the sum of 29,750 euros;

—For Mr , holder of 35,499 shares: the sum of 30,147.15 euros;

—For Mr , holder of 13,515 shares: the sum of 11,487.75 euros;

—For Mr , holder of 14,793 shares: the sum of 12,574.05 euros;

—For , holder of 36,100 shares: the sum of 30,685 euros;

—For , holder of 28,771 shares: the sum of 24,455.35 euros;

—For the holder of 8,943 shares: the sum of 7,601.55 euros;

—For , holder of 8,934 shares: the sum of 1,593.90 euros.

The Defendants will be ordered by B C to pay the aforementioned sums, which will bear interest at the legal rate from the service of this judgment.

VI-On the counterclaim for image damage The Defendants, in order to cross-claim the B C conviction of the Plaintiffs, argue that the latter conducted a smear campaign before initiating the present proceedings.

page 17

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

The fact that shareholders who consider themselves aggrieved to express their grievances in the press, by means of letters to the Autorité des marchés financiers or to seek to meet with a view to legal action, unless they demonstrate bad faith or intention to harm, does not present a faulty character in itself.

This claim will therefore be dismissed.

VII-On the other claims The outcome of the dispute, the fairness and the financial situation of the parties will lead to the application of Article 700 of the Code of Civil Procedure, under which the Defendants will be ordered BC to pay the sum of two thousand euros to each of the Claimants.

The Defendants, who mainly succumb to the proceedings, will be ordered by B C to bear the costs which may be recovered in accordance with the provisions of article 699 of the Code of Civil Procedure.

The provisional execution, necessary, should be ordered.

FOR THESE REASONS, The Tribunal, ruling by contradictory judgment, at first instance and rendered by making it available to the Registry:

DISMISSES the defenses based on the lack of legal basis for the action and the prescription of the action against Mr. Z Y;

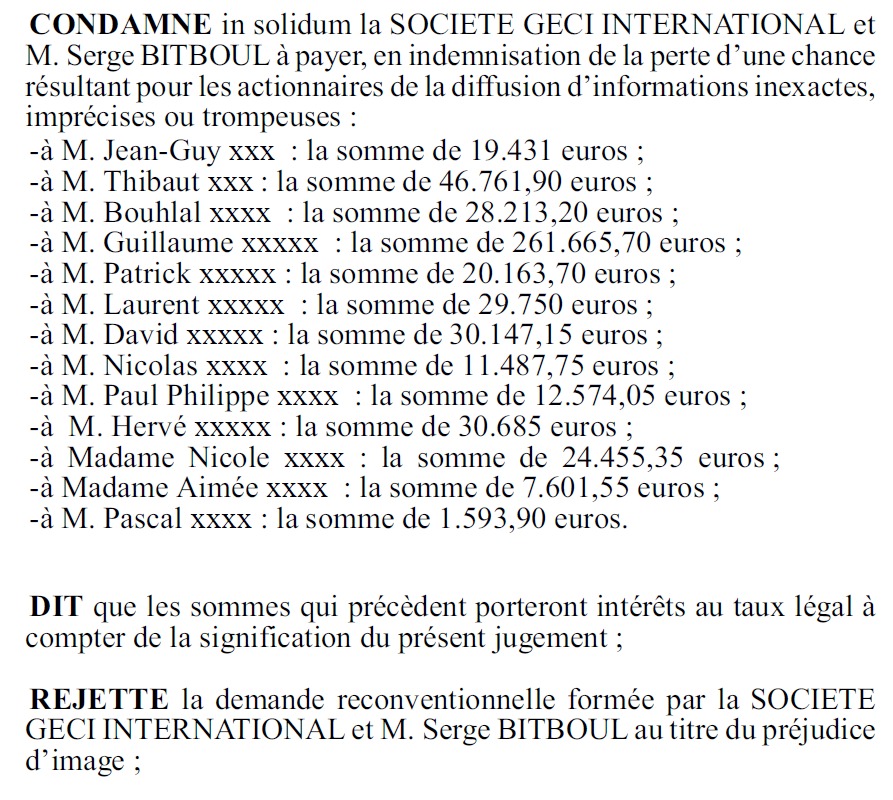

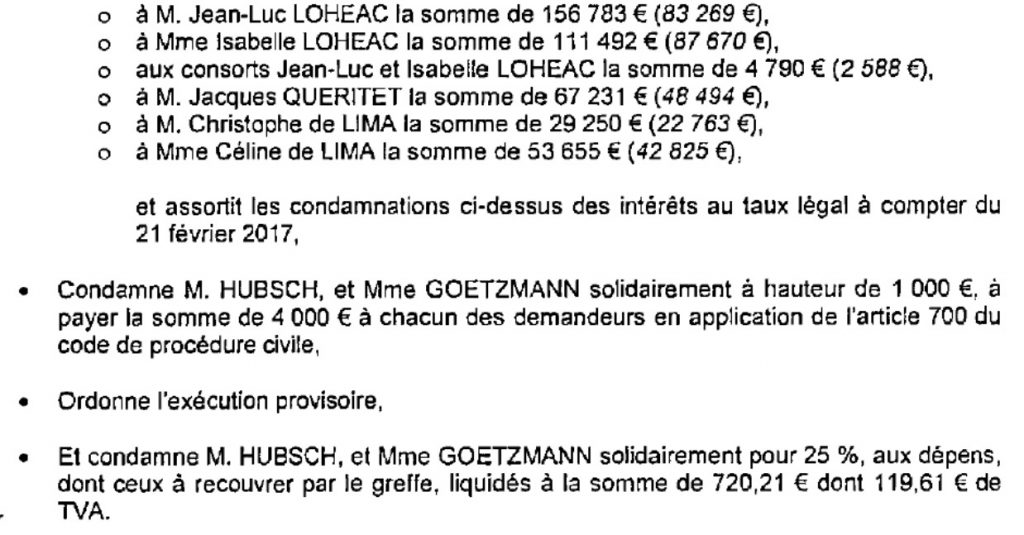

CONDEMN B C the COMPANY GECI INTERNATIONAL and Mr. Z Y to pay, in compensation for the loss of an opportunity resulting for the shareholders from the dissemination of inaccurate, imprecise or misleading information: –: the sum of 19,431 euros; –: the sum of 46,761.90 euros; –: the sum of 28,213.20 euros; -to: the sum of 261,665.70 euros; -to: the sum of 20,163.70 euros; -to: the sum of 29,750 euros; -to: the sum of 30,147.15 euros; -to: the sum of 11,487.75 euros; -to: the sum of 12,574.05 euros; -to: the sum of 30,685 euros; -to: the sum of 24,455.35 euros; -to: the sum of 7,601.55 euros; -to: the sum of 1,593.90 euros.

RULES that the above sums will bear interest at the legal rate from the service of this judgment;

REJECTS the counterclaim brought by SOCIETE GECI INTERNATIONAL and Mr. Z Y for image damage;

page 18

Decision of March 02, 2020 9th Chamber 1st Section No. RG 16/15248–No. Portalis 352J-W-B7A-CJACG

CONDEMN B C the COMPANY GECI INTERNATIONAL and Mr. Z Y to pay each of the plaintiffs the sum of 2,000 euros under article 700 of the Code of Civil Procedure;

ORDERS B C the COMPANY GECI INTERNATIONAL and Mr. Z Y to bear the costs which may be recovered in accordance with the provisions of Article 699 of the Code of Civil Procedure.

ORDERS the provisional execution of this judgment.

Done and judged in Paris on March 02, 2020

The Registrar The President

page 19

Paris Court of Justice, March 2, 2020, No. RG 16/15248 –> Decision.pdf to download

URL on the Doctrine Site: 1st legal intelligence platform

Public links:

Tribunal judiciaire de Paris, 2 mars 2020, n° N° RG 16/15248

Juridiction : Tribunal judiciaire de Paris

Numéro(s) : N° RG 16/15248

TJ Paris, 2 mars 2020, n° N° RG 16/15248. Lire en ligne : https://www.doctrine.fr/d/TJ/Paris/2020/UE2E68EC4DE9E95EDCFC4

Autres décisions de cette affaire :

T. com. Paris, 2 oct. 2020, n° J2019000061. Lire en ligne : https://www.doctrine.fr/d/TCOM/Paris/2020/U1E8F0AE8623EE71199ED

T. com. Paris, 1er févr. 2019, n° 2018018468. Lire en ligne : https://www.doctrine.fr/d/TCOM/Paris/2019/UC212D88AAB67466451D0